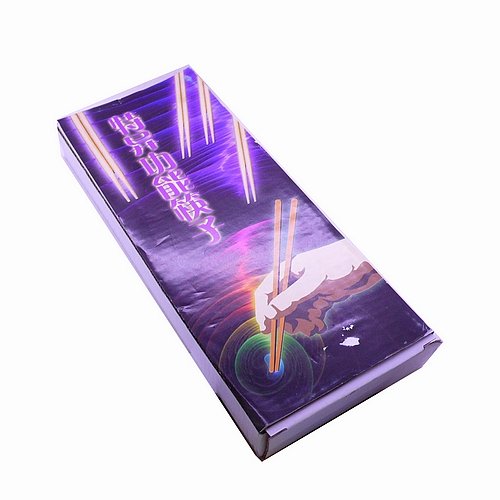

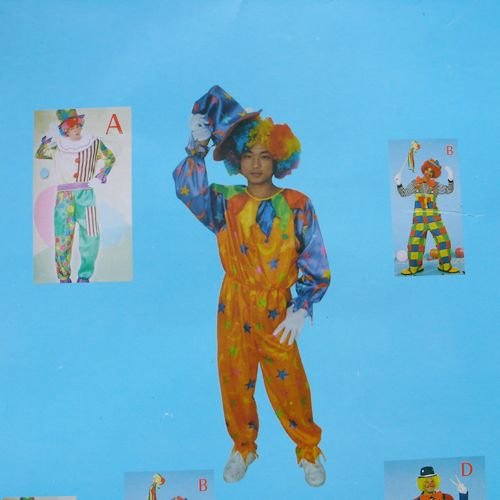

Stage Magic Tricks Biogoraphy

So said the Contrary Investor; and I could not agree more given my sense that the media remains “long” volatility. Indeed, every time volatility increases, so do my phone calls from the financial media as they feel "compelled to come up with rationales for daily movements in asset prices"; last week was no exception. Verily, the week seemed to build on the previous week’s smackdown with Bloomberg’s Erik Schatzker, who I actually like very much, but challenged me on the point that it was the media that first termed the “fiscal cliff” Armageddon. I had averred that it would certainly not be Armageddon, holding fast to the belief that when something absolutely had to happen inside the DC Beltway it has typically happened. My comments were:

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

Stage Magic Tricks

No comments:

Post a Comment